On December 22, 2017, President Trump signed the Tax Cuts and Jobs Act - H.R.1 (referred to as “the Act” for the remainder of this blog post) into law. Many of the provisions took effect on January 1, 2018 and are set to expire on December 31, 2025. The Act contains provisions that impact individuals and employers with both domestic and international cross border relocations. Implications are considered at the individual level and for global mobility programs as a whole.

The major component impacting mobility programs and the relocation industry was the repeal of the qualified moving expense deduction and moving expense reimbursement exclusions. Previously, moving expenses were excluded from taxable wages. Under the Act, these are now subject to federal income tax, FICA/Medicare, FUTA, state and local reporting, and withholding.

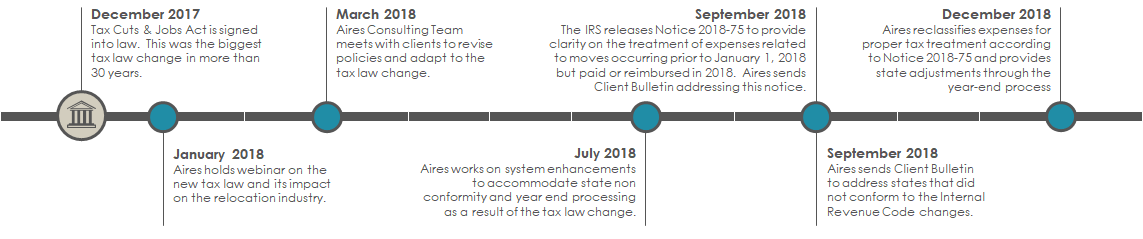

In January 2018 there was uncertainty in the relocation industry regarding how expenses that crossed tax years would be treated. Aires consulted the top tax professionals in the industry and developed a conservative approach to ensure our clients were recording earnings appropriately.

We found that many of our clients also sought guidance from Aires regarding the following impacts of the Act:

- Increased individual assignment costs which were not budgeted from a business perspective.

- Increased overall costs of mobility programs offering tax assistance / tax equalization due to gross up factor in multiple jurisdictions.

- International assignments may not generate enough foreign tax credit to offset additional tax costs where other jurisdictions exempt these expenses from taxation.

- Mobile employees would not be able to deduct moving expenses from personal taxes.

We began working with our clients to explore ways to help mitigate these additional costs while also allowing them to make decisions to support the business, stay competitive with mobile talent, and minimize disruption and hardship for mobile employees. Initial assessments we helped our clients with include:

- Revisiting cost estimates for assignments where moving expenses were incurred after December 31, 2017 and determine extent of additional costs.

- Working with tax service providers to evaluate leveraging unused, excess foreign tax credits.

- Determining cost impact of substituting furnished accommodations for large household goods shipments. (A portion of the furnished accommodations may be excludable under IRC Section 911).

- Determining cost impact of substituting a discretionary allowance for large household goods shipment.

After analyzing the data and taking consideration of all options, most of our clients decided to cover the additional tax costs of Household Goods and Final Move Travel. Although the relocation costs would increase, our clients determined that corporate tax cuts received from the Act would offset majority of the impact. Very few international assignment or tax equalization policies were updated, but where required, clients simply included an addendum referencing the additional gross up on such items.

In September 2018, the IRS issued Notice 2018-75 which provided guidance that if a move occurred or started prior to 1/1/18 the expense could be treated as non-taxable under the previous law. Aires initiated full year reviews for all of our clients and sent corrections with the final payroll reporting. These corrections greatly assisted our clients by reducing earnings to be reported and, where applicable, reduced their overall gross up cost.

The logistics of how to process additional gross ups were challenging due to that fact that some states did not conform to the Internal Revenue Service code. Our clients began to realize that their payroll systems defaulted to state tax treatment consistent with the federal law for relocation earnings reporting. Adjustments were required to our payroll software to account for states that did not treat household goods and final move travel as taxable.

We made enhancements to our systems to produce adjustments that would reduce state earnings as well as the related state tax. We worked with many of our clients to produce payroll adjustments that would also help them save on gross up costs.

A few clients considered adjusting their programs by limiting shipment sizes or offering a discard and donate program to help minimize their employee’s shipments. In some cases, clients offered a small incentive in lieu of storage.

Despite the initial concerns, our clients understood the importance of retaining key mobility talent. By helping our clients implement adjustments that enabled them competitive, we collectively limited the exposure of the tax changes to the relocating employee.

We have included a timeline below to track the Act’s changes.